Oude managers doen vaker slechte cross-border overnames

Last modified: 20 juli 2023 12:17

Mislukt een meerderheid van de overnames omdat de raad van bestuur bestaat uit oude, hoog opgeleide bestuurders uit eigen land? Dat kan worden geconcludeerd uit onderzoek naar duizenden deals. Wetenschappers Killian McCarthy duiken in de cijfers en onderzoeken waarom overnames verkeerd gaan. De samenstelling van de board heeft een grote invloed op slechte deals. Het artikel is geschreven in het Engels.

Door Martijn H Oude Luttikhuis and Killian J McCarthy

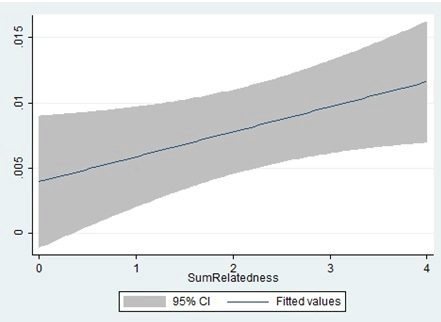

It is well known that ‘exploitive’ cross-border acquisitions – which see the firm cross-borders but stay in its own industry – are more successful than ‘explorative’ cross-border acquisitions – which see the firm both cross borders, and enter into new industries (see Figure 1).

FIGURE 1 Relatedness (horizontal) and performance (vertical)

Blue line: average deal from a sample of 1,040 mergers and acquisitions

But why then are there so many explorative cross border acquisitions? And does the composition of the acquiring firm’s board predict which types of acquisitions occur? Are young, male managers, for example, more likely to make risky mergers and acquisitions than female managers, or older managers? We tested this question using a sample of 1,040 cross-border acquisitions, all of which were announced and completed in the period 1999-2012.

We investigated how six variables – age, gender, education level, nationality, tenure, and the experience – of a board have an impact on the likelihood of making related or unrelated deals.

Looking at each of these variables, we find that:

- Age: younger managers are more likely to engage in related acquisitions, whereas older managers are more likely to engage in unrelated acquisitions;

- Gender: men are more likely to engage in either related or unrelated acquisitions, and women are more likely to engage in partly related acquisitions;

- Education: lower-educated boards are more likely to engage in related acquisitions, while a higher-educated board is more likely to engage in unrelated acquisitions;

- Nationality: domestic boards are more likely to engage in related acquisitions, whereas foreign boards are more likely to engage in unrelated acquisitions.

The results suggest that, on average older, higher-educated boards with relatively few foreign members are more likely to engage in unrelated acquisition. In contrast, a younger, lower educated board with a high percentage of foreign members will rather choose for related acquisitions. Men are likely to acquire either related or unrelated companies, whereas women will rather take-over partly related businesses. Tenure and experience do not influence the likelihood for a particular type of acquisition. Also combining both variables will not influence acquisition type decisions. The number of board members is added as a control variable. A larger board is more likely to engage in partly related acquisitions and smaller boards will rather select companies related or unrelated to the acquiring company.

The results are rather counterintuitive.

For example, one would expect that young mangers would rather choose for unrelated acquisitions. Older individuals increasingly search for security, and become more risk adverse (Carlson & Karlsson, 1970; Vroom & Pahl, 1971), and older boards are said, generally, to be inflexible and resistant to change (Child, 1974; Chown, 1960). It is surprising, therefore, to see that younger boards are less likely to take risks, and older boards more likely. This may be due to the fact that younger boards have yet to prove themselves, and therefore are less likely to walk away from what works, whereas older boards have little to loss with an exploration.

So what does all of this mean?

Well, if shareholders want a board that will engage in unrelated acquisitions, than the shareholders could best compose a board consisting of relative older, higher-educated, domestic managers. If, however, shareholders would rather want a board that makes safer – and more related – acquisitions, then our findings suggest that the board should compose a management team consisting of relative young, lower-educated, and foreign managers.

This of course, raises some interesting questions. How many boards are composed of young, lower-educated, and foreign managers? Could the fact that as many as 85% of mergers fail, in other words, be traced back to the fact that the overwhelming majority of boards are composed of older, higher-educated, domestic managers? This is an interesting conclusion, but one, of course, that requires more research. Watch this space.

References

Carlsson, G., & Karlsson, K. (1970). Age, cohorts and the generation of generations. American Sociological Review, 710-718.

Child, J. (1974). Managerial and organizational factors associated with company performance part I. Journal of Management Studies, 11(3), 175-189.

Chown, S. M. (1960). The Wesley rigidity inventory: A factor-analytic approach. Journal of Abnormal and Social Psychology, 61, 491-494.

Vroom, V. H., & Pahl, B. (1971). Relationship between age and risk taking among managers. Journal of Applied Psychology, 55(5), 399.

About the authors:

Martijn Oude Luttikhuis is a Research Master student in Economics and Business at the University of Groningen. He has a Master’s degree in Strategic Innovation Management, Marketing Intelligence, and Marketing Management.

Dr. Killian McCarthy is assistant professor at the University of Groningen. In 2011, he received his PhD in economics of corporate strategy, for his study about acquisition performance. In this study, Killian evaluated the performance of 35,000+ deals in Europe, North America, and Asia in the period 1990-2010.