Do older CEO’s make better acquisitions?

Last modified: 20 juli 2023 12:26

Achillefs Daskalakis en Dr. Killian J McCarthy, onderzoekers aan de Rijksuniversiteit Groningen, keken naar de correlatie tussen de leeftijd van een CEO en de performance van zijn fusies en overnames. Zijn oudere bestuurders beter in M&A? (Dit artikel is in het Engels)

Door Achillefs Daskalakis en Dr. Killian J McCarthy

On the one hand, older mangers tend to be more experienced, more levelheaded, and less cocky. This should lead older managers to make better deals. On the other hand, however, research tells us that older managers tend to be less flexible, more certain that their way is the best way, and more confident in themselves, as the older and wiser, and therefore better able to see the bigger picture. This implies that older managers may make worse deals (Taylor, 1975; Forbes, 2005; Kovalchik et al, 2005).

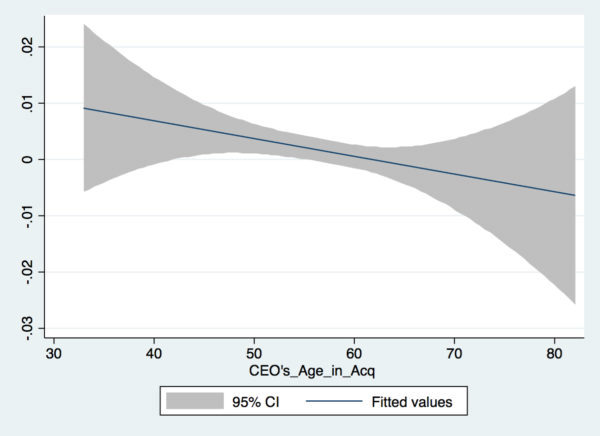

We explored the topic of CEO age and acquisition performance using a sample of 2,217 acquisitions, made by 195 different managers. In each case, we estimate performance by calculating the stock market returns to the acquiring company. Figure 1 plots deal performance (vertical, Y-axis) against CEO age (horizontal, X-axis), and as such shows a negative relationship between deal performance and CEO age. It suggests that older managers, on average, do worse deals; in fact, it suggests that an average manager below 60 creates value, while one above 60 destroys value. The dark line is the trend line, and 95% of our data points fit within the grey-shaded area.

Figure 1 – CEO Age and Acquisition Performance

So why are older managers making worse deals? A possible explanation could be the ‘growing stale in the saddle’ effect (Miller, 1991): older managers being less in tune with the current business realities, and maybe even with their own company. Another could be that of the self serving behavior, feeling that retirement is close; they could act in a way that maximizes their own utility right before they leave the field.

The implications are, of course, clear. The suggestion is that the manager’s age matters, and that as the manager ages, managers should be increasingly monitored. In an aging world where, according to the UN, 2 billion people, or 21,1% of the global population (United Nations, 2013) will be over 65 by 2050, up from 12% today, these are important discussions that will require increasing stakeholder attention.

—

About the Authors

Achillefs Daskalakis is a graduate from the University of Groningen. He completed his Masters Thesis on the topic of CEO Age and Merger Performance. In 2016, Achillefs started his own company, SatiSupp (www.satisupp.com) which specializes in outsourcing customer support, internet marketing and sales.

Dr. Killian J McCarthy is a Professor in the Economics of Strategy at the University of Groningen, and the Director of the Masters Program Strategic Innovation Management. For his PhD he considered the performance of 35,000 international mergers and acquisitions from Asia, Europe and North America.

References

[1] United Nations. (2013). World Population Ageing 2013. DESA. United States: United Nations.

[2] Taylor. (1975). Age and experience as determinants of managerial information processing and decision making performance . Academy of Management Journal , 18, 74-81.

[3] Kovalchik et al, C. C. (2005). Aging and decision making: A comparison between neurologically healthy elderly and young individuals. Journal of Economic Behavior and Organization (58), 79-94.

[4] Forbes. (2005). Are some entrepreneurs more overconfident than others? . Journal of Business Venturing, 20, 623-640.

[5] Miller, D. (1991). Stale in the saddle: CEO tenure and the match between organization and environment. Management Science , 34-52.